We offer tailored advice that will reward you with a strong and secure financial future.

About Us

We are motivated to help clients at any stage of life to build wealth, plan for & enjoy retirement and achieve their dream lifestyle.

Nicholls Wealth Solutions is conveniently located at 27 Takalvan Street, Bundaberg. We are located on the edge of the city centre, on the main thoroughfare with convenient parking at the door. Office hours are Monday to Friday 9 am to 4:30 pm and we also offer after-hours appointments for the convenience of our clients.

Nicholls Wealth Solutions is a leading family orientated Financial Planning Practice, with a dedicated team of Financial Services Professionals who are passionate about our fields of expertise. Our aim is to help you get clear on your goals and take an objective look at your finances. We provide straightforward advice based on sensible, tailored strategies so that you can relax and focus on turning your dreams into reality.

With the right direction, our clients have peace of mind knowing they can access professional financial advice and ongoing support to look forward to a confident and secure future. Now more than ever trying to navigate the increasingly complex tax and super regulations, finding the time to research new investment opportunities and ensuring you meet all the required legal obligations is becoming more and more difficult. That’s why getting professional financial advice from a known and trusted source is essential. We help you define your goals, then transform them into a plan that will allow you to realise your dreams.

All advisers and planning assistants undertake ongoing training at the highest levels to keep to the absolute forefront of the financial planning industry. With the aid of our exclusive in-house computer software programs, we are able to regularly review our client investments. Our uniquely designed website provides security for clients to track their own investment portfolio performance and total financial positions from the comfort of their own home.

Meet the Team

Naomi Nicholls

Practice Principal/Senior Financial Adviser

MFinPlan AFP®

Naomi is a wealth creation specialist and passionate Financial Adviser providing quality advice for over 25 years. Naomi has assisted many clients to help take the stress out of managing money and achieve their goals sooner. She is motivated to help clients at any stage of life to build wealth, plan for & enjoy retirement and achieve their dream lifestyle. She has worked in the financial services industry since 1998 and became a Member (AFP®) of the Financial Planning Association of Australia (FPA) in 1999.

She has attained a Masters Degree in Financial Planning, a Graduate Diploma in Applied Finance, a Graduate Certificate in Applied Finance, Advanced Diploma of Financial Services (Financial Planning) and the Diploma of Financial Services (Financial Planning). She is the Chapter Chair of the FAAA Wide Bay chapter, and has held various committee roles for the FPA over the last 15 years.

With these qualifications and experience, she is well-positioned to help clients achieve their wealth and lifestyle objectives, through providing quality holistic advice. Naomi believes that 'the more that you understand about money, the less you have to think about it. It's about more than just finance, it's about empowering others too.'

Nicholls Wealth Solutions Pty Ltd ABN 97 614 496 678 is a Corporate Authorised Representative of Infocus Securities Australia Pty Ltd ABN 47 097 797 049, AFSL 236523.

Michael Portley

Practice Manager

JP (Qual)

With a background in banking and finance, Michael commenced his career with a large financial institution and has over 22 years' experience in the industry. He has seen first-hand the enormous positive that good financial advice can bring to people.

As the Practice Manager, Michael is the engine room of the office and oversees all IT requirements, account management, compliance obligations and office maintenance. Feel free to call him with any questions or updates. Michael is also a JP (Qual) and is available to assist members of the community with witnessing of documents as they require.

Chris Ottway

Paraplanner

AdvDip (FinPlan)

With a background of over 20 years' of client and administration management, with a very high level of professionalism and passion to exceed client expectations. Chris has been providing administrative support in the financial planning industry since 2016 and joined the Nicholls Wealth Solutions team in July 2022. He brings a wide range of cross-industry skills from experience working within the Employment Services industry, Retail environment and Real Estate & Construction Industry Associations. Highly focused, Chris is driven by providing top quality service to ensure a superior client experience.

Chris has attained an Advanced Diploma of Paraplanning and consistently implement new efficiencies in the office to streamline processes and enhance client interactions.

Jude Ottway

Adviser Services Manager

DipFP

Jude joined the Nicholls Wealth Solutions team in May 2025, bringing with her over 11 years of administrative experience in financial planning and an additional decade of expertise from the higher education and mining sectors. With a passion for helping clients achieve their goals and a commitment to excellence, Jude plays an essential role in assisting the team in gathering information and implementing strategies to support clients’ financial plans. Jude also holds a Diploma in Financial Planning, enhancing her ability to deliver exceptional service.

Emma Foster

Client Services Officer

The first person most clients come into contact with at Nicholls Wealth Solutions is Emma. Emma joined us in August 2018, and has quickly become an indispensable member of our team. In addition to organising your appointments, and warmly greeting you when you arrive at our office, Emma also takes responsibility for assisting in the day-to-day service to our clients.

Emma's role is integral to the implementation of your financial plan and ongoing reviews. Her duties range from reception and maintenance of client records to assisting in practice management. Emma is available to assist the team and clients with their CSO enquires and has recently completed her Certificate ||| in Business Administration.

The services we supply along the way to help you attain your short and long term financial goals.

Our Services

Keep up to date and educated with your finances.

Latest Financial Planning News

AI exuberance: Economic upside, stock market downside

The key findings of Vanguard’s economic and market outlook to be released in...

Becoming a member of an SMSF is easy, but there are other things that need to be considered

There are very few restrictions on who can become a member of an SMSF, but there are conditions with which...

Investment and economic outlook, November 2025

The latest forecasts for investment returns and region-by-region economic...

Move assets before death to avoid tax implications

Mitigating the impact of death benefit tax can be supported by ensuring the SMSF deed allows for the transfer...

ATO issues warning about super schemes

The ATO is warning SMSF trustees to be on the look out for superannuation and tax...

12 financial tips for the festive season and year ahead

Some investing steps to get you through the holiday season, the new year, and for the...

Birth date impacts bring-forward NCCs

The provisions allowing SMSF members to trigger the NCC bring-forward rules in a subsequent financial year are...

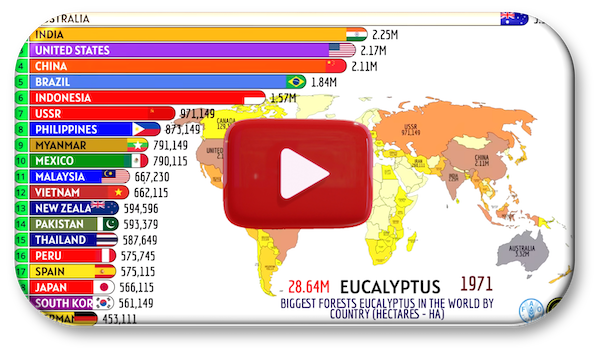

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree...

How to budget using the envelope method

Here's five simple steps to create a budget that doesn't involve tracking every...

Client Resources

Get in touch with us. We're here to help you.

Contact Us

We welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Office Location

- Shop 1, 27 Takalvan Street,Bundaberg West, QLD, 4670

- PO Box 5301, Bundaberg West QLD 4670